How can a different mindset actually make me smarter financially?

By observation. Yes, that’s right, it’s that simple. By observing your mindset, you create the potential for change. Maybe you’ve heard this before in Quantum Theory. If you haven’t, here it is in a nutshell: electrons behave differently when they are observed (Observation Affects Reality)! I know what you’re thinking here, we’re talking smarter personal finances not quantum physics! But no worries, this really is simple stuff.

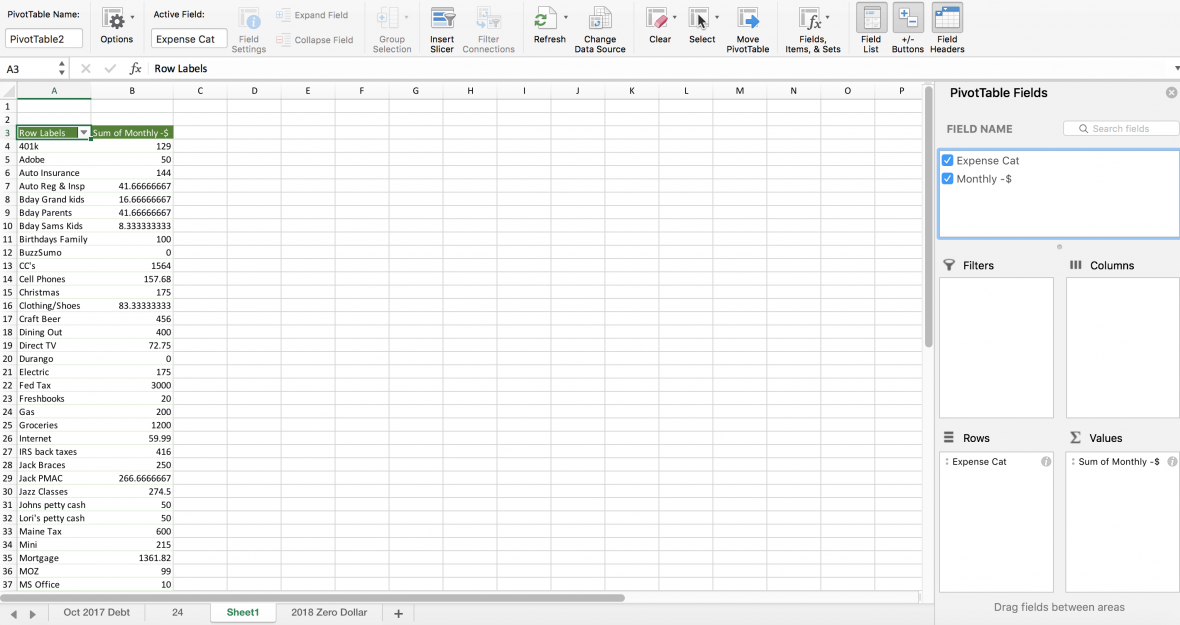

So let’s jump right in. If you use a personal finance software, this first step is going to be super easy, and save you lots of time. Take a look at your spending for the last 3 months. If you don’t use a personal finance software, you might try exporting the transactions for the last 90 days from your online bank account into a spreadsheet. It will take a little work, but if you add a category column, and fill in the purchase and income categories you’ll have some intelligible data to use. Next, just make a pivot table with the categories as rows, and amounts summed and you have what you need. Do you see why we believe personal finance software is a real time saver?

Either way, what we’re going for here is a bird’s eye view of how much money you made over the last 90 days, and where it went. While you do this exercise, think about any bills or expenses you couldn’t tackle because of lack of funds. And if you put ANYTHING on credit cards during this period, well…

This simple exercise is a real eye opener and game changer.

Step 1: Become aware of spending choices

Do you see some category spending that is discretionary? Investopedia describes discretionary this way: “Discretionary income includes money spent on luxury items, vacations, and nonessential goods and services.” In other words, money you have left over after the bills are paid. If you couldn’t pay your self employment taxes or utilities bill on time, but managed to spend a whole lot on dining out at your favorite restaurant (ahem), then there is a problem. You’ve just found in reality what you’ve been considering free cash to spend is actually deficit spending!

Step 2: Making a commitment to better spending habits, using a zero-based budget.

A zero-based budget sounds like it might be complicated, but it’s really quite easy. Sticking to it is where you’ll test your moxy.

We’ve already written a detailed article on zero-based budgeting, so here I’ll keep it short and sweet. You budget every dollar in your checking account(s) available for spending, You prioritize your most important categories first (think shelter, food, etc. before new shoes). If you don’t run out of dollars to distribute, you budget your “important but not critical” expenses next. An example would be, you have to pay your mortgage or rent or else… so that gets funded first. While you like your DirectTV subscription, that would not come before other must-haves like electricity. If you’re close to already being pretty responsible, you’ll even have some money left over for the fun stuff, like eating out at that favorite restaurant and other discretionary spending.

The key here is, if you’re diligent and stick to the plan, you’ll never get behind the proverbial eight ball. Good bye to the paycheck to paycheck stress and blues!

Step 3: You’re sailing along, and kaboom!

Your car needs a major repair. Wait, that’s not in the budget, what now? For many here’s where they fall off the horse (unfortunately many don’t get back on it until the next New Year’s resolutions). Let’s say this emergency with the car ended up costing you $600 “un-budgeted” dollars, but you’ve already earmarked other dollars in your “important but not critical” categories. Unlike when you were flying blind, you have actionable choices. By taking cash reserves from your entertainment, dining, clothes and other “discretionary” categories for example, you avoid the “charge it” impulse. Hint: when you use the envelope budgeting system, this is super easy to do.

I know personally, when that set back moment comes, it is hard, real hard! After all, pulling out that Platinum Visa card is not only easy, most of us have a false association of gratification (like Wimpy’s “I’ll gladly pay you Tuesday for a hamburger today.”) If you can stitch together a few victories like these in a row, not only will you disrupt the debt pattern and gain momentum to keep at it, but you begin to see new insights within your financial pictures. You start winning, and want to win more!

We’ve covered a lot here, so I’ll leave you with this: every journey begins with a step, and the first step in becoming financially stable, is to create a new personal finance mindset that will without a doubt lead you to more happiness, and less stress!

I still don’t have to see how it works with having very limited income

Hi Trisha, the most important thing to adhere to when working with a limited income is the zero-based budget. It’s not going to be comfortable at first, because you’ll only be able to spend the money you have, and you’ll be basing that by priority. In a nutshell, things that are not essential will be cut away, until your expenses are within your means. The prioritization is important. And when things are tight due an unplanned expense it will require diligently sticking to the plan. But I can tell once you start like this, you’ll feel better about the expenses you have, and you’ll never have to worry about your essentials like mortgage/rent, electric and debt payments. For us, once we started this, we found we needed to start a secondary income. My wife has been selling things on local Facebook groups for example. It’s free to list, and people actually are coming to the house and buying things we no longer have use for, or those well intended Christmas gifts we never took out of the box. I hope this helps! Best of luck!

How do I produce a multi-column / period report using Banktivity please?

What I struggle with is that if I budget with the envelope system, which I find by far the easiest. Instead of keeping money for one-off charges per year, say a holiday, or tax or an annual car service, I don’t want to use physical envelopes with cash, as I pay for most things on my debit card; not in cash. But if I save, say, € 100 per month for holidays, without taking it out in cash, my account shows as if I have plenty of money for that meal out, whereas *I HAVEN’T*, because I need to keep that €100 aside… Is there an easier way to do this, or would moving the cash I need to save into an on-line savings account, and keep an Excell sheet with the details be the answer?

You should use all of your credit cards as debit cards. And have two bank accounts.

One for debit, day to day expenses.

One for savings that work for actual savings, but also for rainy days. See below.

Don’t use your cards to buy things you can’t afford.

Immediately enter your transaction with a category (an enveloppe) and you know right away whether you can afford something or not. Every spending should be, in your head, as a paper enveloppe and real cash inside (physical bills). You don’t have enough for restaurant tonight? Then take money from your “clothing” enveloppe.

That way, money is not abstract, it’s real. You go to the restaurant at the expense of your new shoes. You see the impact of buying things you can’t afford right away.

Another advice: for annual recurring expenses, set aside 1/12th of the annual invoice.

You will save money each months into a savings account for rainy days.

For example: annual car insurance is $1,200, set $100 aside each month. When that invoice shows up, you have that money aside and available without impact on any other enveloppe the day you have to pay that bill. It doesn’t come as a surprise, and you won’t feel a knot in your stomach.

Same for each quarter. $300 for house, apartment insurance every quarter? No problem, set $100 aside each month. Now every three months, you have $300 handy.

Now zero budgeting is the main goal: once you set aside money for all categories, then if any dollar is left, then you can set that aside for other things like the new TV or smartphone you want. Once you have the amount available, you buy it. Otherwise, you just don’t. And you won’t go into debts.

Once thing that most people do wrong is think that the money in the bank account is money available. No, that’s wrong. You can have $20,000 in the bank but only $1,000 available as the $19,000 others are already engaged to another purpose, reserved for something that will show up no matter what.

Once you make the switch in your mind to think “zero based budget”, you won’t even understand how it was possible to live without this way of thinking (and behaving).

These are great tips Steve! Thank you!