For many people, a budget is the driving force for taking control of their finances. It literally tells you how much you expect to earn, where you expect to spend it and where you’ve over- or under-spent. But in the world of budgets, are all budgets created equal? Why do some people try budgeting over and over again, but it never sticks, while others start with a budget and it marks their turning point to getting their financial house in order?

In this article, we explore envelope budgets and why they are easy to conceptualize and extremely effective. It should be noted that sometimes people refer to envelope budgeting as zero-based budgeting. So if that was ever confusing, now you should be unconfused.

So what is envelope budgeting?

The idea behind envelope budgeting is easy. It goes like this: you have some money and you allocate that money to specific upcoming expenses. You can only allocate the money you have and you should allocate all of your money (thus the other name, “zero-based,” as you allocate your money down to zero). We put together this page on envelope budgeting that breaks it down even more.

Now you might be wondering how the envelope budgeting name came about. Well, way back in the day before iPhones, or even personal computers for that matter, you would get paid, take your cash and then divvy it up into envelopes earmarked for different expenses. Each envelope would store the money you would need for an upcoming expense, like rent, groceries, eating out, utilities, and so on. When it came time to go grocery shopping, you would literally take cash out of the envelope and go shopping with it. If you had money left over, you could leave it there for the next time you needed food, or move it to another envelope.

The next time you got paid, you’d divvy up your cash into the envelopes, filling the most important ones (like rent or mortgage) first, and leaving less important ones (like dining) until the end. Importantly, if you were a savvy budgeter then you’d also have envelopes for vacation, new car, Christmas and some other upcoming expenses. This last part is very important, as it is one of the main reasons budgeters “fall off the wagon” if they don’t use envelope budgeting.

So those are the basics of envelope budgeting. You have some money, and you decide where you’ll spend it, with highest priorities first and lowest priorities last, all while seeing the big picture and making sure you are putting aside some money for those big expenses (you know they will come eventually!).

How does this translate into the modern era? Well, the good news is, it translates exceptionally well. In fact, it is way easier to use the envelope method with Banktivity than it is to actually track cash in real envelopes shoved in your desk drawer. In Banktivity, categories in your budget act as your envelopes. As you spend in one category, the amount of money in that envelope is reduced.

Now, astute readers might be wondering, “Well that sounds fine and dandy, but I’m always putting bills, groceries and even rent on my credit card. My credit card doesn’t turn off when I spent the amount I’ve allocated to groceries. How am I supposed to handle the case when I overspend in a category?” This is a very important point, so much that it deserves its own section.

Handling overspending

I’m going to let you in on a little secret: everyone overspends in one category or another of their budget. Now, with a non-envelope budget, the big problem is that when you overspend, there is no signal that you need to do anything about it. You might decide, “oh, I should be more careful.” But it rarely alters the rest of your spending, so you end up not sticking to your budget and feeling like a budget isn’t helping you.

With envelope budgeting, if you overspend in a category, you must take action. You have a certain amount of cash allocated to your envelope categories. You can’t just ignore the red amount. If you do, you won’t be sticking to your budget and, frankly, you won’t be getting the results you want from your budget. So, you have to do something. What do you do? You take money from a different envelope to replenish the negative one. Envelope budgeting is different in this way, because it requires you to take an active role in managing your finances. This isn’t a bad thing – in fact, it is absolutely awesome! Taking an active role in how you spend your money is likely the only thing that will help you achieve your financial goals.

Here is an example of overspending. Let’s say you have three envelopes with the following amounts in them:

Clothing/Shoes $50

Dining/Restaurants $65

Rent $1000

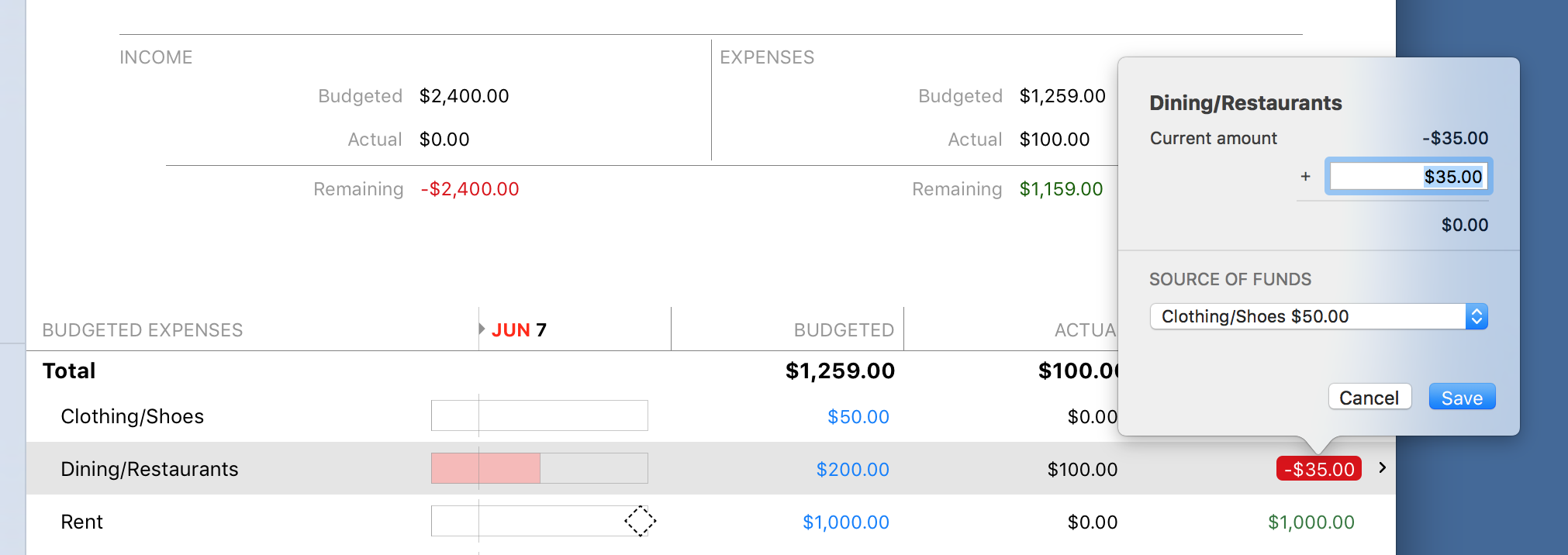

You then go out to eat and decide to pick up the check, treating your friends. Whoops, the bill comes to $100. In Banktivity you’ll see -$35 in the Dining/Restaurants envelope because you had $65 in there, but spent $100 (65-100=-35). Now to bring that envelope back to zero, you have to do something. Here are your options:

- Take $35 out of your Rent envelope

- Take $35 out of your Clothing/Shoes envelope

I’d argue that having a roof over your head is more important than getting that nice pair of shoes you were eyeing. So don’t pinch from your rent envelope, choose #2 and wait another day for those shoes (or practice going barefoot).

This example is simplified, but the idea is the same. If you overspend in one envelope, you must take it from another envelope. Some clever folks might be thinking, “I’ll just wait until I get paid next, then I’ll refill my overspent envelopes.” You could do this, but you shouldn’t – you are just robbing Peter to pay Paul. Either way, you have the same number of dollars to spend, but by pulling from cash in an existing envelope, you are holding yourself accountable.

Envelope budgeting is truly an amazing way to budget; it is easy to conceptualize and highly effective. Banktivity makes envelope budgeting easy by walking you through the setup, calling out where you’ve overspent your envelopes and making it easy to move money between envelopes. If you’ve tried budgeting in the past, but couldn’t stick with it, or if this is your first time considering budgeting, give Banktivity’s envelope budgeting a try. You’ll have a plan – a plan you can follow – and a way to hold yourself accountable should you stray from your plan.

Good article. I have tried using the Envelope feature in the past without much success, but I am inspired to try it again when I set up my budget for next year.

[ENHANCEMENT REQUEST] I have always wondered why the Banktivity categories do not have a Priority feature on which reports could be sorted. I have worked around this by inserting an alpha prefix to the categories (e.g., aMortgage, bGroceries, cDining), but it’s a bit kludgey. Setting the priority within the category characteristics, and then being able to sort by category, would be very helpful.

SIDE NOTE: It would also be helpful to be able to sort reports alphabetically by category. For example, I find the Cash Flow Summary report to be less useful because the categories are listed by amount spent. While that information is good to know, that’s essentially what the pie chart is for. I’d rather have the option of sorting the categories by name (or priority) so I can find them more easily in the report.

Thanks for sharing your feedback on how Banktivity could be better for you! I’ll pass it on through internal channels so the developers are aware.

Very helpful. I’m still trying to implement. Large family/Lots of Categories!

Thanks for the information. I’ll try envelope zero based budgeting for 2018

Envelope budgeting is why I chose to get Banktivity. I’ve been doing this with cash for years, glad I can now do this with software.

Going to give it a shot in 2018!

I would like to have the following possibility in setting up envelopes: Divide my salary into the different envelope with a constant value month after month. (I would like to affect amount A to envelope 1, amount B to envelope 2 and so on month after month) . For example I would like to assign as in your example 65$ for Dining and restaurant every month. If I overspend for example 100$ I will have -35$ as in your example. The difference is that instead of pinching in the clothing envelope, I would like to reduce the amount available for dining the following month. For example January starts with an envelope of 65$. I spend 100$ meaning I have -35$. The next month, February, the dining envelope is refilled again with 65$ so I will have available: -35$ + 65$ = 30$ available for the month. I might the decide not to go to the restaurant. The next month, March, I will then have available 65$ more. I will have available 65$ +30$ = 95$ for March,

In that way I will have an average of 65$ per month available.

With your example, I could be tempted to overspend in one category and compensate with another category. Of course my budget will also be followed but not with an average repartition of my money over the categories.

Is there an easy way to fill the envelopes having a constant value per month as in my example.

Even better would be to specify a specific amount monthly but also having a different value on certain months . For example having a greater amount in the envelope in December for X-mas presents, than for the other months.

I think the biggest challenge are stores such as Amazon.

Typically, Banktivity does a great job remembering how I classify transactions (restaurants, groceries, doctor, clothing, vacation, gasoline). My challenge is Amazon. I buy so many items there now. It ranges from Entertainment, Food, Pet Supplies, Electronics.

Is there any way to make this simpler so I’m not having to split every transaction in Banktivity so that I know where the money is going?

I’m moving over from Moneywell and really miss the ability to drag/drop money from one envelope to another. That, combined with the pre-filled amount set to balance the destination envelope to $0 made cleaning up overspent envelopes very easy.

On the Fill Envelope Screen, my “envelopes” are not in alphabetical order. I can alphabetize them but when I close that screen and reopen, the envelopes are reverted back to order they were in. How do I change the order and leave them in that order???

You can drag and drop them into your preferred order.